Stevie Swai

When it comes to life, there are two things I am 100% certain of : Number one – there are no secrets when it comes to communication, and number two is that my mentor, trading partner, and pal, Trader Scott, knows his stuff when it comes to markets. Obviously we speak markets all the time, and it’s truly amazing how many prescient calls he (humbly) shares with me. So this one was about something from August of 2016.

Yesterday a reporter Ryan from Buzzfeed contacted Scott. Buzzfeed intended to quote something from an email that Trader Scott had sent to Milo Yiannopoulos 16 months ago. Wait, what? How did he come to obtain a private email which was sent to Milo? We hashed over that spooky question for a moment and decided we didn’t really want to know. Then I broke into an anxious sweat hoping that Scott’s acerbic, yet colorful wit had not stained that email, leaving anything in it to be interpreted the wrong way. How many careers and lives have been ruined by misinterpretations after all? And why did he write to Milo anyway?

Well it seems Trader Scott had heard some rubbish coming from Milo one day about Twitter where he incompetently said that (other incompetent) “big money” was looking at (incompetently) shorting TWTR. So being the experienced trader that Scott is (and all around good guy), he wasn’t going to sit by and let Milo make that mistake. I mean, if a blind man was getting ready to step in front of a moving train, would you just stand there and let him? And furthermore, Milo’s bad ideas about market moves could have influenced a whole crop of Miloites to blindly follow suit and lose a lot of money. So Scott simply emailed Milo to share his knowledge about why Twitter should not be shorted at that time.

This is the part of the email to Milo that was referenced in the Buzzfeed story:

“TWTR is down tremendously already over the last year. Most of the problems TWTR faces have already been discounted by the price drop. I certainly am not claiming that TWTR can’t drop way more, but the lowest RISK/ highest PROBABILITY trade for TWTR would be on a large rally in the stock price, where shorting into strength would be a much more viable opportunity. I would love to see TWTR get clobbered, but my “job” requires me not to be biased when it comes to my market operations.”

So there’s the background, and the story’s below. Looks like the Buzzfeed team was rather thorough in their investigation; it’s an interesting read. And as for us, well, we have no bias either way. I’m just happy my partner is getting a little recognition for being the great trader he is, which brings a third certainty to mind – we ALWAYS do our best to keep you on the right side of markets.

For more than a year before he became Donald Trump’s campaign manager, Steve Bannon sought to wage war against Twitter, tasking Milo Yiannopoulos and other Breitbart News employees to look into editorial, financial, and legal ways they could harm the Jack Dorsey–led social network.

Steve Bannon and his associates at Breitbart News planned a broad financial, legal, and editorial campaign to damage Twitter, according to documents obtained by BuzzFeed News.

The campaign, waged in the months before Bannon left his job as chair of Breitbart and took control of Donald J. Trump’s presidential run in August 2016, sought to devalue and weaken the social network that had banned his employees and, he believed, silenced conservative voices.

“Should we sue Twitter?” Breitbart’s then–technology editor Milo Yiannopoulos wrote in an email to his boss in late July 2016. “I’d crush the optics.”

“Yes,” replied Bannon, before continuing in another follow-up email. “Already talked to lawyers.”

Drew Angerer / Getty Images

Steve Bannon

These messages, and other documents shared with BuzzFeed News, reveal a strategy to conduct a sustained, three-pronged war against Twitter. It included a deluge of negative coverage about Twitter on Breitbart, explorations of potential litigation against the San Francisco company, and nascent plans to sabotage Twitter’s volatile stock with financial institutions and traders.

While social media companies have become regular targets of the pro-Trump right, Bannon’s focus on Twitter — which has struggled to define and enforce its policies on harassment, abuse, and free speech — underscores how vital a battleground the platform is in the current culture war. And it illustrates how these companies, desperate to be seen as neutral actors, have been dragged out of that position by dogged political forces.

The emails within Breitbart also highlight the complex relationship the alt-right’s enablers had with Twitter, which was instrumental in spreading their ideas and electing their candidate, but whose alleged censorship made it a magnet for their antagonism.

The face of that antagonism was Yiannopoulos, who sought constant advice from Bannon and used his suspensions and eventual expulsion from Twitter as ammunition to attack the company and its CEO, Jack Dorsey. Under Bannon’s guidance, Yiannopoulos examined state laws to see if there were avenues for potential litigation and made plans to contact short sellers about sandbagging Twitter’s shares. In October, BuzzFeed News revealed that Yiannopoulos, Breitbart’s most recognizable figure until his scandalous departure in February of this year, sought the opinions and contributions of racists, white nationalists, and neo-Nazis for work published on the right-wing news site.

Breitbart News, Yiannopoulos and Bannon did not respond to requests for comment.

Three former Twitter executives said that they did not focus on Breitbart’s public fixation with their company. One noted that while there were some discussions about Yiannopoulos’s suspensions and Breitbart’s regularly critical coverage, the company was more concerned with warnings of actual violence, like ISIS’s threat that it would harm the company’s employees for banning terrorist-related accounts in 2015.

“There wasn’t a red alert meeting every day, and the company viewed Breitbart sort of like, ‘Get in line with the other craziness on the platform,’” that person told BuzzFeed News.

“Twitter was unaware of any campaign of this nature,” a company spokesperson said in a statement.

The emails from within Breitbart expose the measures Bannon, the brawling champion of the new populist conservative politics, is willing to take to humble the tech giants — a fight he continued in the White House and has kept up since leaving the administration in August. (BuzzFeed News reported in September that Bannon tried to plant a mole inside Facebook.) More than a year later, as public opinion on the left and the right alike turned against big tech, the emails reveal just how deep the antipathy toward Silicon Valley ran in Bannon’s anti-globalist circles long before it became bipartisan sentiment.

When contacted by BuzzFeed News, the former Twitter executives — who asked to remain anonymous for fear of endangering business and personal relationships — were surprised to hear of Breitbart’s plans to interfere with Twitter, especially given Bannon’s proximity to the Trump campaign. From a financial standpoint, Twitter’s shares were already among the most shorted among technology stocks, and it’s unclear if Breitbart’s strategy to affect the company’s share price ever went beyond an exploratory phase.

“There were plenty of other reasons to short Twitter,” he added.

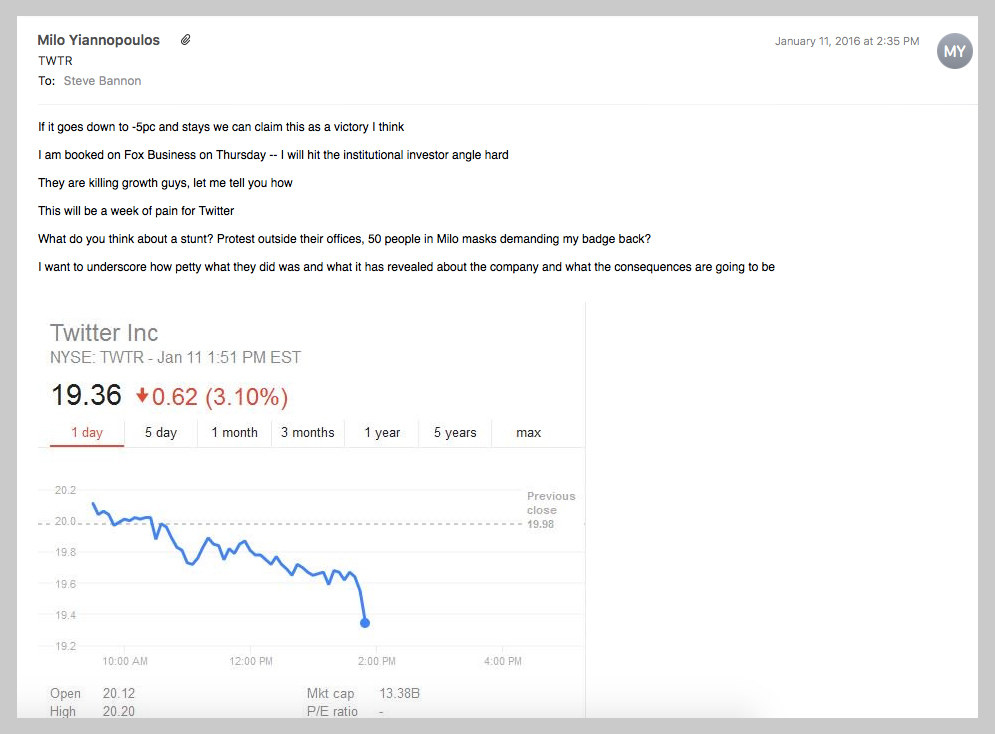

On Jan. 11, 2016, Milo Yiannopoulos emailed Steve Bannon a screenshot of Twitter’s stock, which had dropped more than 3% during day trading. The company’s shareholders may have been hurting, but Yiannopoulos was in the mood to celebrate: He was convinced Breitbart had helped drive down Twitter’s share price.

“If it goes down to -5 [percent] and stays we can claim this as a victory I think,” wrote Yiannopoulos above the image. “This will be a week of pain for Twitter. … I want to underscore how petty what they did was and what it has revealed about the company and what the consequences are going to be.”

Two days earlier, Twitter had removed Yiannopoulos’s verification check mark, a status symbol among the social network’s power users, without disclosing why. Breitbart’s response was swift and coordinated: a barrage of stories about Twitter’s antipathy toward conservatives, the ways the disciplinary measure had backfired, and a list of “criminals, abusers, and harassers” who had not lost their verification.

“I love this company,” Yiannopoulos had written earlier on Jan. 9. “You guys think exactly like I do. Fuck Them Up.”

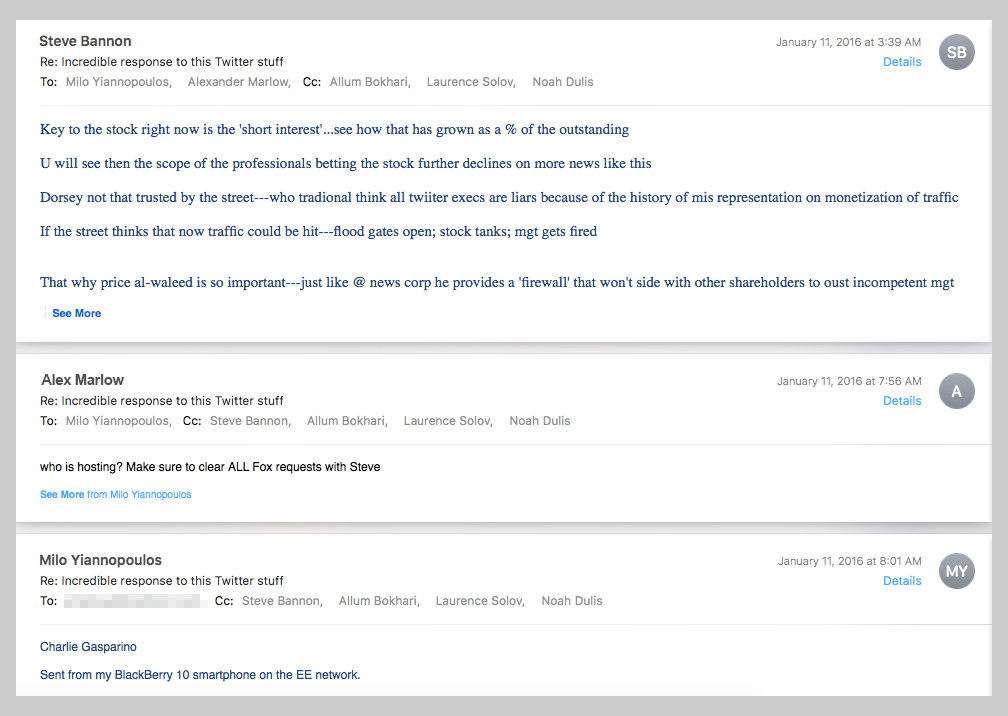

The outrage caught on. The archconservative Breitbart found grudging sympathy from a wide range of mainstream outlets, including the Guardian and BuzzFeed News, which ripped Twitter for a lack of clear and consistent standards. “The breitbart machine rolling,” Bannon wrote in an email to Yiannopoulos, Breitbart editor Alexander Marlow, and Breitbart Chief Financial Officer Larry Solov.

As the scope of interest in the story became clear, Bannon — a former Goldman Sachs investment banker — turned his attention to the company’s plunging stock.

“Key to the stock right now is the ‘short interest,’” Bannon wrote in the same email chain, referring to investors betting that the stock price would continue to fall. “U will see then the scope of the professionals betting the stock further declines on more news like this.” Bannon thought the company’s weak response to a fundamental problem — it was a speech company, after all — would exacerbate Wall Street’s skepticism towards Twitter’s leadership.

“Dorsey not that trusted by the street—who traditional think all twiiter execs are liars because of the history of mis representation on monetization of traffic,” Bannon wrote. “If the street thinks that now traffic could be hit—flood gates open; stock tanks; mgt gets fired.”

For months, Bannon had encouraged Yiannopoulos to hammer Silicon Valley. Bannon, who in his role as chief strategist recently led a push within the White House to regulate major social platforms like Google and Facebook as utilities, saw those companies as fundamentally biased against conservatives, and sought to paint their leaders as out-of-touch coastal elites and their success as artificial.

“Tech bubble Bursting before your eyes,” he wrote to his Yiannopoulos in August 2015. “Get something up. Facebook; twitter getting crushed.” And in December 2015, Bannon forwarded a New York Post story about then–Yahoo CEO Marissa Mayer’s “lavish spending” to his tech editor with instructions: “you must own this bro.”

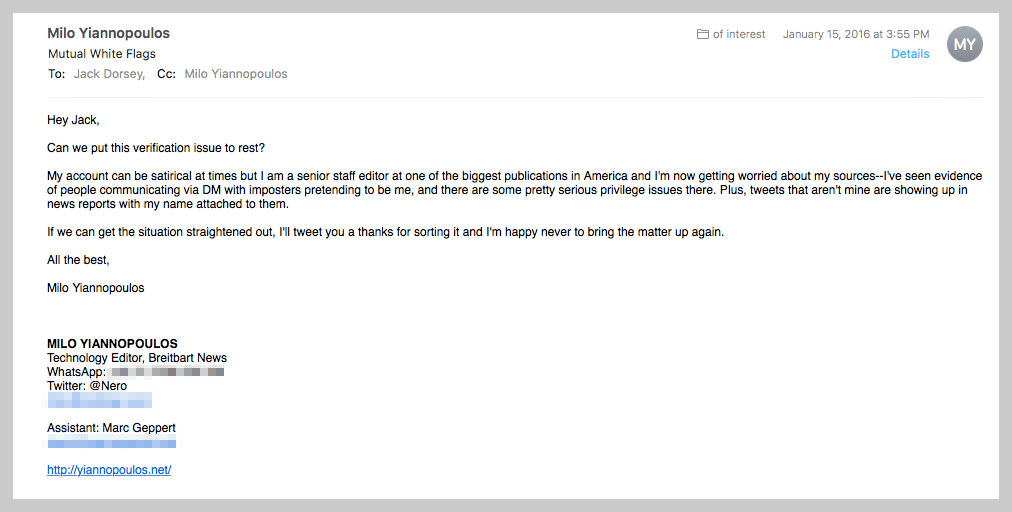

On Jan. 15, Yiannopoulos sent a peace offering to Twitter — a cordial email to Jack Dorsey asking for his verification to be restored in exchange for a detente. A screenshot of an email tracker Yiannopoulos used registered that the email was opened 111 times.

But Dorsey never responded.

And so the “#war,” as Bannon called it, carried on. If Yiannopoulos’s claim was correct — that negative coverage stemming from his conflict with Twitter was hurting its stock price — he and Bannon had natural allies in those who stood to gain financially from Twitter’s loss.

Shorting stocks, or placing a bet that a stock will fall by borrowing shares to sell them and then rebuying them at a later date, is a common strategy among investors; according to financial analytics company S3 Partners, as of August 2017, nine of the 12 most-shorted stocks in the US were in the technology sector. Some hold that shorting can become a self-fulfilling prophecy: If enough people bet against a stock, it can worry other investors enough to sell their shares, pushing the price down and benefiting the short investors.

Twitter’s stock, which had plunged from nearly $70 a share in January 2014 to $17 at the time of Yiannopoulos’s de-verification, was one of the most shorted stocks on Wall Street, a fact that was compounded by stalling user and revenue growth, a lack of product direction, and other self-inflicted mistakes. If one wanted to hurt Twitter in early 2016, ginning up more short interest in the stock would have been a way to do it.

One of the investors who claimed to have benefited from Twitter’s plummeting stock was the notorious conservative activist — and former Breitbart reporter — Charles C. Johnson, who was banned from Twitter in May 2015 for a tweet that referenced “taking out” Black Lives Matter leader DeRay Mckesson. Johnson had boasted to Yiannopoulos even before the latter’s de-verification that he had “made a lot of money shorting Twitter” and offered to “cut [him] in.” In response, Yiannopoulos asked for more details, writing, “We do have laws where journalism and the stock market are concerned.”

“I was ready to help forge the sword to cut off Twitter’s head,” Johnson told BuzzFeed News.

After the run of Breitbart stories about Yiannopoulos’s de-verification, Johnson began to email Yiannopoulos more frequently about damaging Twitter. “A billion dollar hedge fund manager called me to talk twitter today,” Johnson wrote to Yiannopoulos on Jan. 11, 2016. “I made $100k just today on what you did.” And throughout the next several days, the men exchanged dozens of emails about the stock price, about Twitter’s inflated user numbers, and Johnson’s plans to, as he wrote in a Jan. 17 email, “go seriously short Twitter.” “Want to know if you’re serious about fucking them up,” he said.

“I’m serious,” Yiannopoulos responded.

A #ShortTwitter sticker seen in San Francisco.

Johnson didn’t just short Twitter from behind the scenes. He had helped create a Twitter account @shortthebird in July 2015 and organized a campaign to put stickers and posters up around the company’s San Francisco headquarters with the hashtag #shorttwitter. (The hashtag never really took off, however, as it was simultaneously being employed by Twitter users to joke about their physical stature.) Johnson also trolled Twitter investor Chris Sacca by sending a photo of himself standing in front of Twitter’s building and a note about how much money he had supposedly made when the company’s shares hit a new all-time low on Jan. 8.

Still, despite his goading, Johnson said that Yiannopoulos did not collaborate with him on his bets against Twitter.

“Milo pussed out,” Johnson said. “He was all talk when it comes to taking down Twitter.”

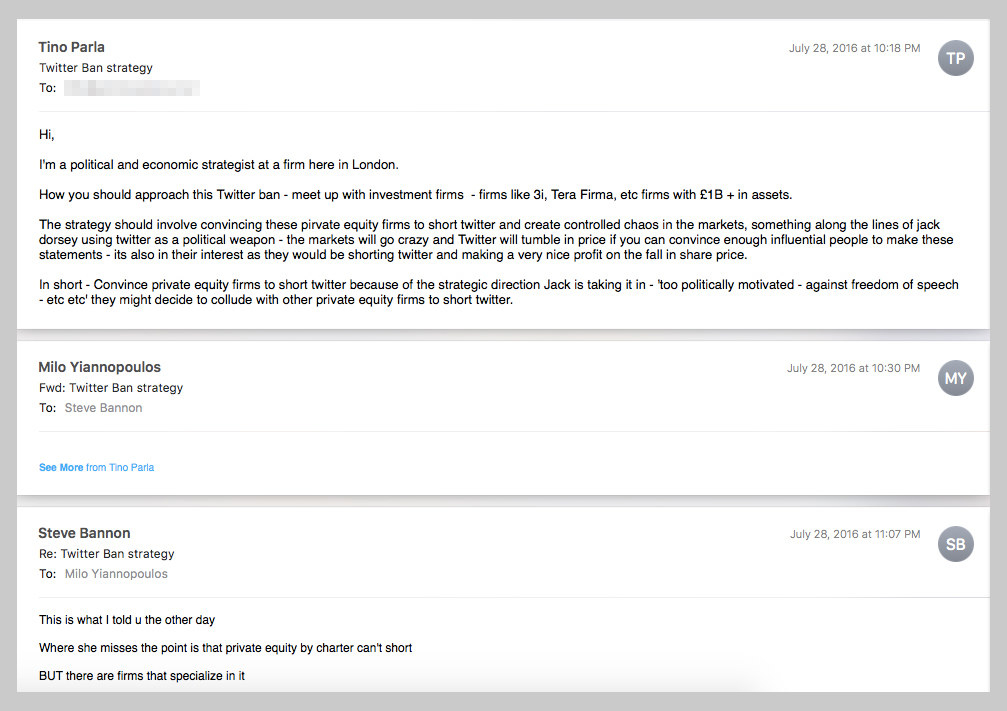

It’s unclear whether Yiannopoulos himself or anyone affiliated with Breitbart ever shorted Twitter. But, emails show, Bannon at least considered it. On July 19, Yiannopoulos was banned from Twitter. Nine days later, he received an email from a person who identified themselves as Tino Parla, a “political and economic strategist,” advising him to “convince private equity firms to short twitter because of the strategic direction Jack is taking it in.” Yiannopoulos forwarded the email to Bannon. (Parla did not respond to an emailed request for comment.)

“This is what I told u the other day,” Bannon wrote back. “[T]here are firms that specialize in it. We need to go see them.”

BuzzFeed News could not confirm whether these meetings took place. But on Aug. 1, Yiannopoulos gave an interview to Business Insider UK in which he said, “I know serious players who are about to short Twitter.”

Others who spoke with Yiannopoulos rebuffed him by noting that the opportunity to short Twitter had already passed by the summer of 2016. Trader Scott, an anonymous writer who maintains a blog on the popular anti-establishment finance blog Zero Hedge, saw the Business Insider interview and sent an email to the Breitbart star. “I would love to see Twitter get clobbered,” he wrote, but the company’s shares were “down tremendously already over the last year” and thus would be too risky to bet against. Yiannopoulos sent the email to Bannon, who responded, “I agree that all the easy money has been made.”

“The reason I initially sent something to him was because it was an incompetent and emotional thing to say,” Trader Scott told BuzzFeed News. “Some people love Milo and they follow what he says. Some unfortunate people may have shorted Twitter based on that and lost a lot of money.”

Since Aug. 1, 2016, Twitter’s share price is up more than 32%.

Richard Drew / AP

Twitter CEO Jack Dorsey

As Yiannopoulos and Bannon considered their financial options against Twitter, they also discussed a salvo of attacks against the social networks using the US court system. One of their inspirations may have been the Obama White House.

At a March 4, 2016, White House press briefing, Yiannopoulos lobbed a question at White House press secretary Josh Earnest about the administration’s views on what he called Twitter and Facebook’s “censoring and punishing conservative and libertarian points of view.” (continue reading)

That is long read but a good lesson when we put emotion into a trade rather than knowing how to read a chart .

Very good analysis (take away) from the post Visao. We all have emotion, we can’t ignore it, but we need to learn how to work with it in markets.

Though many campaigns are carried out as described in the article, timing is everything (and detachment) good on Scott for calling BS and another good reminder to focus on the “entry point”… allot of people could’ve hurt themselves because of their agenda. Thanks Scott for all the insight you give! (Nice memory keep-sake;))

Right and thanks. Gives some perspective on how tricky it is to judge “strong-hands”. Just because people have a lot of money, doesn’t mean they have a clue. And it gets back to the great Richard Wyckoff’s “composite operator” and how brilliant it is.