The Entry Points

President Trump was on twitter again this weekend, and now he wants to take credit for cutting the national debt. Seriously? He’s been in office for about 5 weeks and – voilà. Yes, it’s really that easy. He should do an infomercial about how easy this all is. The President and his supporters took credit for the “surge” in Holiday spending. And they are taking credit for the “surge” in jobs coming back to America, and the “new” bull market in stocks. Of course, keeping it hush-hush that the stock market actually bottomed on 3/6/2009, and had tripled by the time he took office. While they also completely ignored President Obama’s crappy economic policies led to one of the greatest bull markets ever. In fact, both he and his supporters constantly mocked (as did I) Barack’s laughable claims about how the strong stock market was “proving” his policies were working. President Trump, in 2015 claimed stocks were in a bubble, and we totally disagreed with him then, and still disagreed with him when he repeated his false claim 6 months ago – “big, fat, ugly bubble”. But now as the stock market keeps setting record highs, it’s somehow great and super and downright bullish. Seriously? And what about all of the wild claims about the President’s great US$ bull market. Yet after this completely normal and re-strengthening selloff in the $, now those claims are not heard anymore. So we now move forward and we hear all of the (incompetent) claims about all of the great things which the new President has “accomplished”. But in fairness we have to recognize this incompetence is par for the course, as all new Administrations make false claims. But as to Trump’s claims about his great debt reduction policies we can add this – the biggest part of the future liabilities, Social Security and Medicare, will see no cuts in the Trump budget. So no cuts to the entitlements, a massive infrastructure plan, and big tax cuts, and voilà. Seriously?

Here is a recent interest interview of Grant Williams on the Rise of Populism, Trump Rally, China, Gold & More.

If you prefer to read, here is the transcript of the interview .

Good interview. I would recommend others check it out.

The thoughtful article that Grant Williams referred to and written by Mr. Luke Gromen of “The Forest for the Trees” can be found here. Reading it will not help one to make money in short term in gold and commodities. But it can help in medium and long term.

At present time, US dollar is the major reserve of central banks. If Mr. Trump sets up big border tax and break and renegotiates trade deals without a careful plan and implementing in a sufficient length of time, the disruption of trades will also diminish the role of the dollar. If US consistently runs big trade surplus (which I doubt it), the dollar in the foreign central banks will steadily shrink and it will force the other countries to give up dollar and set up a different monetary system.

Totally agreed Easy Al. Thanks for the link. We are heading for a totally different monetary system, more profound than Bretton Woods.

Hi Scott,

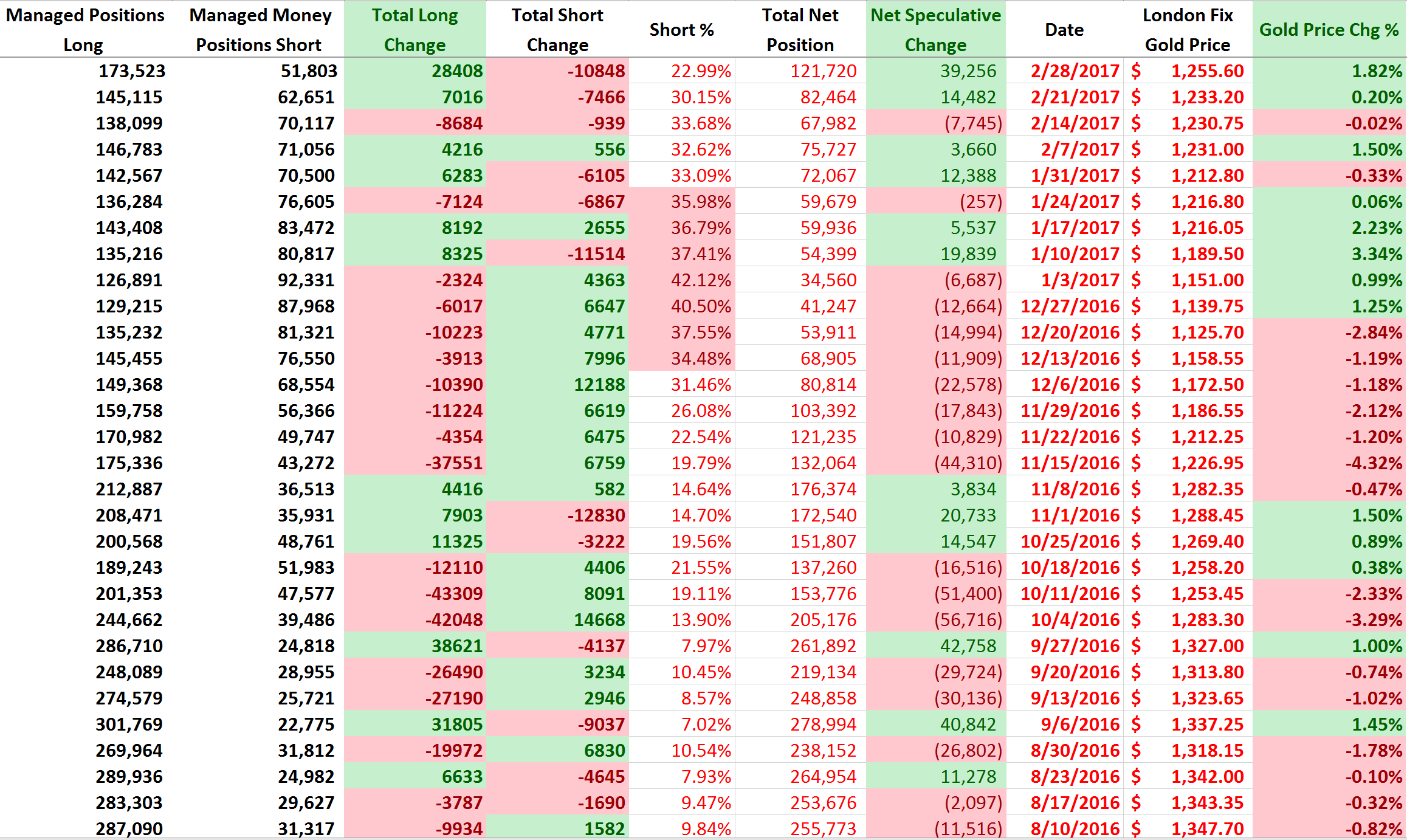

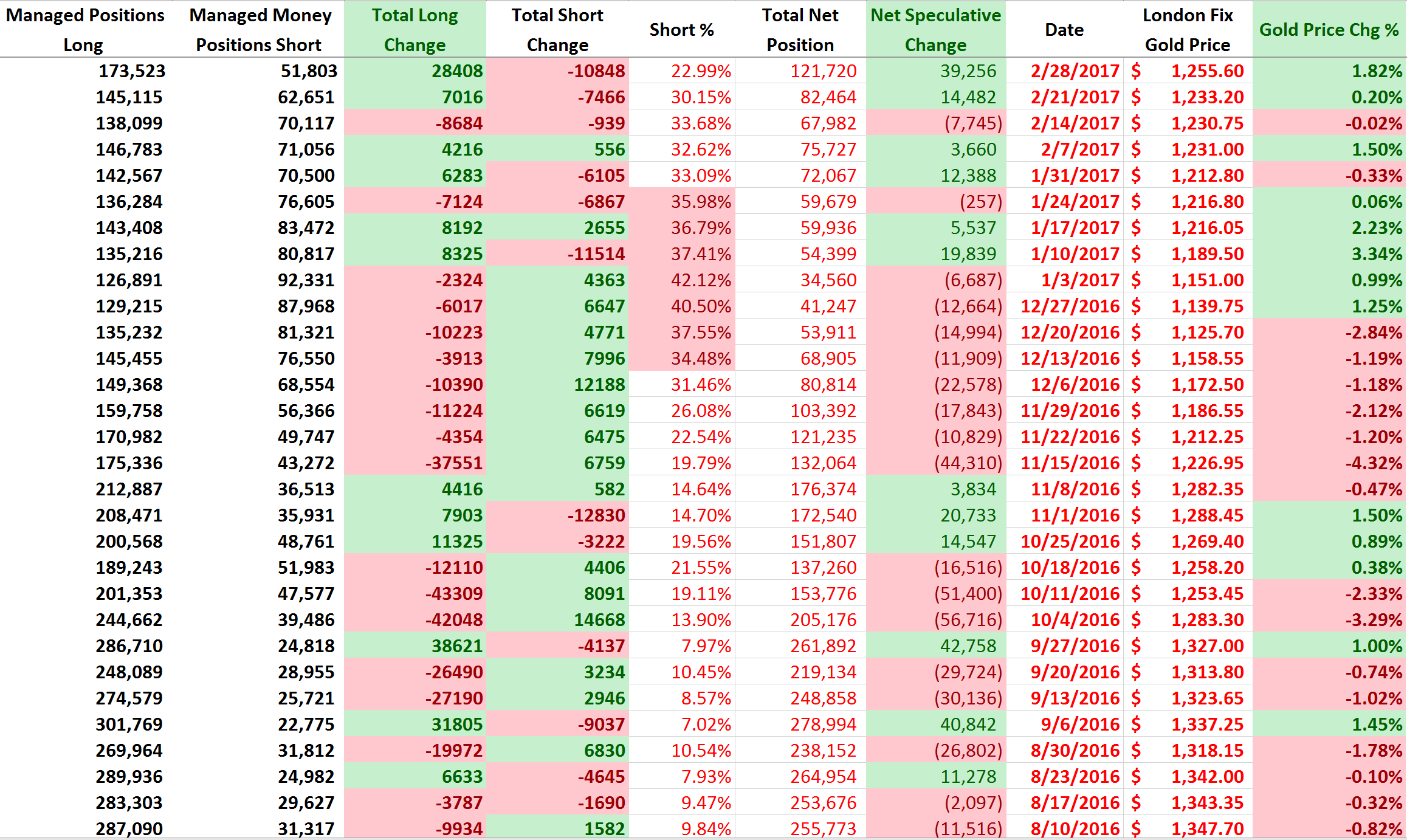

I am just testing if a graphic summary of the latest gold COT report from another site will be displayed here;

Have at it – test away. Let me know Easy Al.

Well, the image didn’t show up. It looks like the html code was completely ignored. The link for the image is . The html code that I entered was

. The html code that I entered was

img src=” ” /

” /

(where the angle brackets have been removed. It looks like any item within the angle brackets will not be displayed). I verified that the code works properly in one of the online html code tester.

I’ll have the tech guy look at your comment. Thank you.

Hi Scott,

It’s great that charts from other websites can be directly displayed in the comment field. We do not have say something like see the 2nd chart of the article linked here.

And for me, you guys are free to post. I am out of the picture.